Scalping has gained popularity as a trading strategy that leverages frequent trades within a short timeframe to capitalize on minor price movements. Although it carries inherent risks, when implemented correctly, it can yield significant profits. Adaptrade, a powerful software tool, assists traders in developing and testing their own scalping strategies. With its advanced capabilities, Adaptrade enables traders to customize their scalping approach to align with their unique trading style and preferences.

This post delves into the process of constructing a scalping strategy using Adaptrade, covering essential aspects like market selection, defining entry and exit criteria, strategy testing, and optimization. Additionally, it presents a real-world case study illustrating an Adaptrade-built scalping strategy and highlights the benefits of utilizing Adaptrade for scalping. Whether you're a novice scalper or an experienced trader, this article serves as a valuable resource, providing insights on crafting a successful scalping strategy with the aid of Adaptrade.

Building a +Scalping strategy with Adaptrade

Adaptrade is a sophisticated software tool designed to empower traders in creating and evaluating their customized trading strategies. Leveraging advanced algorithms, Adaptrade generates trading signals based on user-defined rules and facilitates performance testing using historical data. Traders, especially those engaged in scalping, can greatly benefit from Adaptrade's features. By utilizing this tool, traders can refine and optimize their strategies, enabling them to pinpoint lucrative trading opportunities within volatile markets.

To build a scalping strategy using Adaptrade, you would follow these general steps:

Define your Scalping Strategy:

- Determine the market and instrument you want to trade.

- Define your time frame for scalping (e.g., seconds, minutes, or ticks).

- Specify your entry and exit criteria for trades.

- Consider factors such as volatility, liquidity, and spread.

Gather Historical Data:

- Acquire historical price data for the instrument you want to trade.

- Ensure that the data includes the necessary information for your strategy, such as price, volume, and time.

Create a Trading System with Adaptrade Builder:

- Launch Adaptrade Builder, a software tool for developing trading strategies.

- Import the historical data into Builder.

- Specify the entry and exit rules for your scalping strategy using Builder's rule-building tools.

- Define any additional criteria or filters, such as stop-loss levels or profit targets.

- Use Builder's optimization features to fine-tune the strategy parameters and find optimal values.

Evaluate Strategy Performance:

- Test the strategy using the historical data within Builder to assess its performance.

- Analyze key metrics such as profitability, drawdowns, win/loss ratios, and risk-adjusted returns.

- Consider using out-of-sample testing to validate the strategy's robustness.

Refine and Optimize:

- Modify the strategy parameters or rules as needed to improve performance.

- Use Builder's optimization capabilities to search for optimal parameter values.

- Ensure that the strategy remains robust across different market conditions and time periods.

Implement and Monitor:

- Export the final strategy code from Builder.

- Connect the strategy to your preferred trading platform or brokerage account.

- Test the strategy in a simulated or paper trading environment before deploying it with real funds.

- Regularly monitor and review the strategy's performance to make any necessary adjustments.

Note that the specific process may vary depending on the version and features of Adaptrade Builder you are using. It's essential to consult the software documentation and tutorials provided by Adaptrade for detailed instructions on using their platform effectively.

What is a +Scalping strategy

A scalping strategy is a short-term trading approach that aims to profit from small price movements in the financial markets. Scalpers typically enter and exit trades within seconds, minutes, or a few ticks. The strategy is focused on capturing small price increments and accumulating numerous trades over a short period.

Here are some key characteristics of a scalping strategy:

-

High Frequency of Trades: Scalpers aim to execute a large number of trades within a short timeframe, taking advantage of even the smallest price fluctuations.

-

Small Profit Targets: Scalping strategies often target small profit levels per trade, typically just a few ticks or pips, as the focus is on frequent trading and capturing quick gains.

-

Tight Stop-Loss Levels: To manage risk, scalpers utilize tight stop-loss orders to limit potential losses in case the market moves against their position. These stop-loss levels are usually set very close to the entry point.

-

Short Holding Periods: Scalpers hold their positions for only a brief period, ranging from a few seconds to a few minutes, allowing them to quickly move on to the next trade opportunity.

-

Technical Analysis: Scalping strategies often rely on technical analysis indicators, chart patterns, and price action to identify short-term momentum or reversals.

-

Liquidity and Volatility: Scalpers prefer markets that have high liquidity and volatility, as these conditions provide more frequent trading opportunities and tighter bid-ask spreads.

-

Advanced Order Types: Scalpers may utilize advanced order types, such as market orders, limit orders, or stop orders, to ensure swift execution and manage slippage.

It's important to note that scalping can be a challenging trading strategy, as it requires quick decision-making, precision, and a high level of focus. It also involves frequent transaction costs due to the high turnover of trades. Traders implementing scalping strategies should have a thorough understanding of their chosen markets, risk management techniques, and access to reliable and fast trading platforms.

Case Study

To demonstrate the process of constructing a scalping strategy with Adaptrade, we will explore an example focused on trading the EUR/USD currency pair.

Setting up Adaptrade Software

Begin by downloading and installing the Adaptrade software on your computer. Once installed, create a new trading strategy and select the EUR/USD currency pair as the target market.

Identifying a Suitable Market

The EUR/USD currency pair offers ideal conditions for scalping due to its high liquidity and tight spreads. Concentrate on the European and US trading sessions, as they tend to be the most active and volatile.

Defining Entry and Exit Criteria

Utilize a combination of technical indicators and price action patterns to determine potential entry and exit points for the scalping strategy. Consider the following criteria:

Entry criteria

Combine the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators to identify oversold conditions. Confirm entry by observing a bullish reversal pattern. Exit criteria: Implement a trailing stop to secure profits and minimize losses. Set a profit target of 10 pips.

Incorporating Risk Management Strategies

To manage risk effectively, place a stop-loss order 5 pips below the entry price. Continuously monitor the market for sudden volatility spikes and adjust position sizes accordingly.

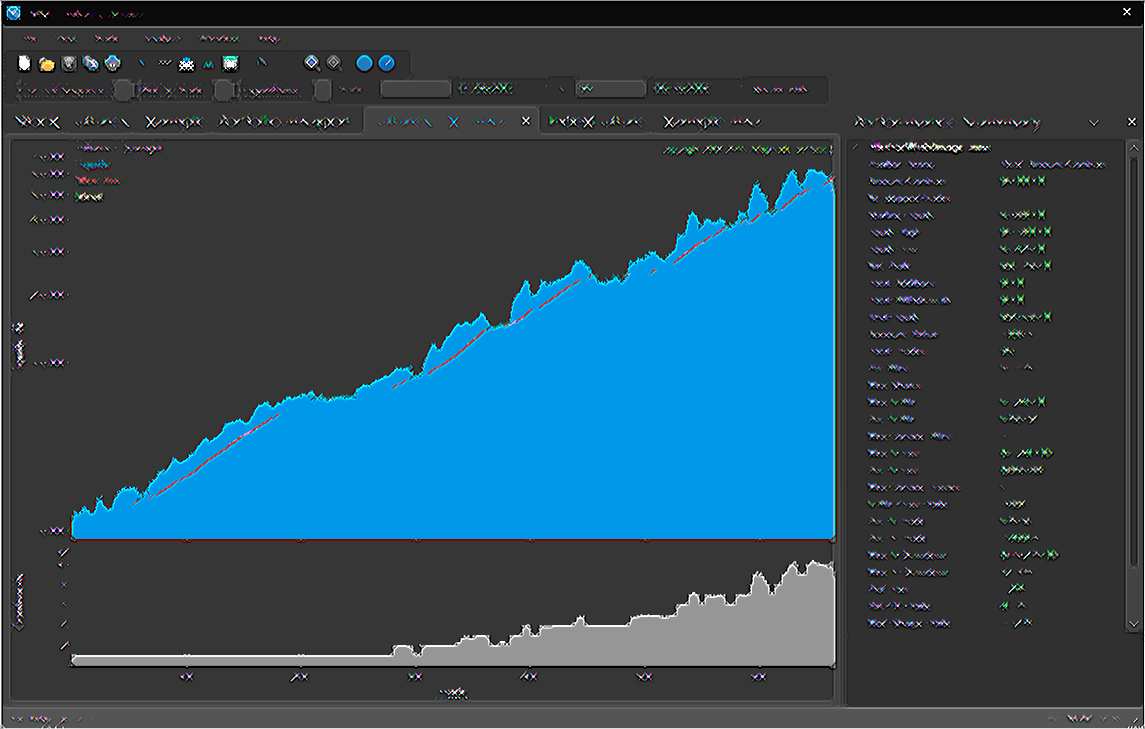

Testing and Optimizing the Strategy

Leverage Adaptrade's optimization tools and backtesting capabilities to test and fine-tune the scalping strategy. Vary indicator parameters and trailing stop values to identify the optimal settings. Test the strategy across multiple timeframes and market conditions to ensure its robustness.

Final Thoughts

Adaptrade proves invaluable for traders aiming to develop successful scalping strategies. Its powerful optimization and backtesting capabilities enable fine-tuning and robustness testing before live trading. By testing different indicators, timeframes, and market conditions, Adaptrade allows for customization tailored to individual trading styles and preferences.

Adaptrade's risk management features, including stop-loss orders and position size adjustments, aid in effective risk management and loss limitation. Incorporating these risk management strategies into the scalping strategy enhances the potential for long-term profitability.

Written by Michael Zippo

Michael Zippo, passionate Webmaster and Publisher, stands out for his versatility in online dissemination. Through his blog, he explores topics ranging from celebrity net worth to business dynamics, the economy, and developments in IT and programming. His professional presence on LinkedIn - https://www.linkedin.com/in/michael-zippo-9136441b1/ - is a reflection of his dedication to the industry, while managing platforms such as EmergeSocial.NET and theworldtimes.org highlights his expertise in creating informative and timely content. Involved in significant projects such as python.engineering, Michael offers a unique experience in the digital world, inviting the public to explore the many facets online with him.